Why Auditor-General Nancy Gathungu is set to audit fuel levy billions

Auditor-General Nancy Gathungu is set to audit how the billions of shillings that are collected from the Petroleum Development Levy each year were used.

The National Treasury, in its submissions to the International Monetary Fund (IMF), said the audit will be completed and published by the end of January next year.

Monies collected from the levy are put into the Petroleum Development Levy Fund and are only supposed to be used to stabilize the price of fuel when costs spike.

The levy is charged at Ksh5.40 on each liter of petrol and diesel sold in the country and Ksh0.40 on each liter of kerosene.

In the financial year ended June 2023, the government collected Ksh25.2 billion from the fuel levy, according to official figures from the Ministry of Energy and Petroleum.

According to the Treasury, Gathungu’s audit will also recommend the triggers that will guide the release of the funds for fuel price stabilization.

The Auditor General’s Office will conduct and publish a comprehensive audit of the use of funds in the PDF and the fuel pricing mechanism and recommend actions to strengthen the design of triggers for price stabilization decisions with clear parameters that are not only a function of market prices, exchange rate developments, and margins of the oil marketing companies, but also of resources concurrently available in PDF for stabilization purposes (in view of potential shortfall in levy collections under the PDF and development spending funded from it).

the national treasury

The Treasury says that this process will enable it together with the Ministry of Energy and Petroleum to ringfence the resources budgeted for price stabilization purposes.

This comes at a time when the government has been put on the spot several times for diverting the fuel levy to other uses such as construction of roads in contravention with the law.

This diversion of resources leaves the kitty largely empty and therefore not able to perform its function of keeping prices stable when import prices of the commodity skyrocket.

At the same time, the Treasury reiterated the government’s stance of avoiding subsidies on fuel. This has been a key commitment of President William Ruto, who was put under pressure by the IMF to end the subsidy due to its negative impact on the exchequer.

Consistent with our requests for access under the IMF’s Resilience and Sustainability Facility (RSF), we are committed to transitioning to low-carbon economy by avoiding fossil fuel subsidies going forward.

the national treasury

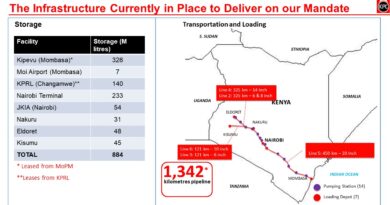

Kenya imports all its fuel in refined form, mainly from the United Arab Emirates (UAE) and Saudi Arabia. This means that local prices are dependent on global prices of oil as well as the performance of the Kenyan shilling against the US dollar.

info@theenergyreview.com

Discover more from THE ENERGY REVIEW

Subscribe to get the latest posts sent to your email.